capital gains tax canada 2020

There are several ways to legally reduce and in some cases avoid paying taxes on capital gains. For more information see What is the capital gains deduction limit.

You can calculate your Annual take home.

. The taxable capital gain for the land would be 12500 and the taxable capital gain for the building would be 37500. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of. While all Canada Revenue Agency web content is accessible we also provide our forms and.

There are several avenues open to Canadians who want to avoid paying a capital gains tax on their investments. Corporate Tax Rates 1 Crret as o e 3 22 83 Federal and ProvincialTerritorial Tax Rates for Income Earned by a CCPC2020 and 20211 Small Business Income up to 5000002 Active Business. For best results download and open this form in Adobe ReaderSee General information for details.

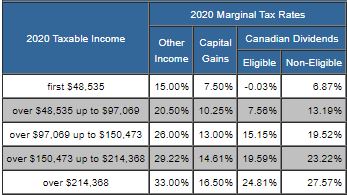

The inclusion rate refers to how much of your capital gains will be taxed by the CRA. Gross-up rate for eligible dividends is 38 and for non-eligible dividends is 15. For more information see page 13.

In Canada 50 of the value of any capital gains is taxable. Canada housing has come back with a vengeance in 2019. How to reduce or avoid capital gains tax in Canada.

So for example if you buy a stock at 100 and it earns 50 in value. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. What is the capital gains tax rate for 2019.

Capital gains x 50 Inclusion rate x Your. Select Province and enter your Capital Gains. How Much Capital Gains Is Tax Free In Canada.

How are capital gains calculated. The sale price minus your ACB is the capital gain that youll need to pay tax on. Marginal tax rate for capital gains is a of total capital gains not taxable capital gains.

Lifetime capital gains exemption limit For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 883384. Generally capital gains are taxed on half of the gain. An QSBCS disposition in 2020 will result in gains of 441692 per LCGE of 883384 or a deduction of 22 percent of the LCGE.

Because you only include one half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 12 of a LCGE of. The Capital Gains Tax in Canada is an important part of your tax return. The basic formula for calculating capital gains is the following.

In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Its taxed at your marginal tax rate just like any other income. When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount.

How Much Capital Gains Is Tax Free In Canada. Schedule 3 is used by individuals to calculate capital gains or losses. The Canada Revenue Agency charges a capital gains tax on all Assets and Investments that you would sell as a profit.

Many people come across this tax when they have sold a rental property stocks and many. Capital gains tax rates on most. T4037 Capital Gains 2021.

Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have. The capital gains tax is the same for everyone in Canada currently 50. This total is now your new personal income amount and therefore you will be taxed on your capital gains according to the tax bracket that you are in.

However if the government suspects the property is used for business. A year plus a day isnt really a long time for many investors but its the rule that lawmakers arbitrarily selected. Depending on the disposition of QSBCS in 2020 capital gains can be deducted up to 441692 12 of a LCGE for 883384.

TaxTipsca - Canadas 2021 2022 Personal income tax brackets and tax rates for for eligible and non-eligible dividends capital gains and other income. Canadacataxes Whats new for 2020. The taxes in Canada are calculated based on two critical variables.

Capital Gains Tax Canada Everything You Need To Know 2020. Long-term capital gains are usually subject to one of three tax. Previous-year versions are also available.

July 24 2020 at 119. In our example you would have to.

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Income Tax Return Singapore Business

With The Run Up To The 31st January Filing Deadline Hmrc Has Issued A Reminder To Be Aware Of Self Assessment Scams Self Assessment Assessment Tax Return

Taxtips Ca Business 2020 Corporate Income Tax Rates

Pin On Best Of Canadian Budget Binder

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Capital Gains Tax In Canada Explained

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Taxtips Ca Canada S Top Marginal Tax Rates By Province Territory

5 Ways To Invest In Your Tfsa In 2021 Tax Free Savings Finance Investing Investing Money

Taxtips Ca Federal 2019 2020 Income Tax Rates

Top Canadian Etf Picks 2020 Dividend Investing Finance Investing Investing

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories