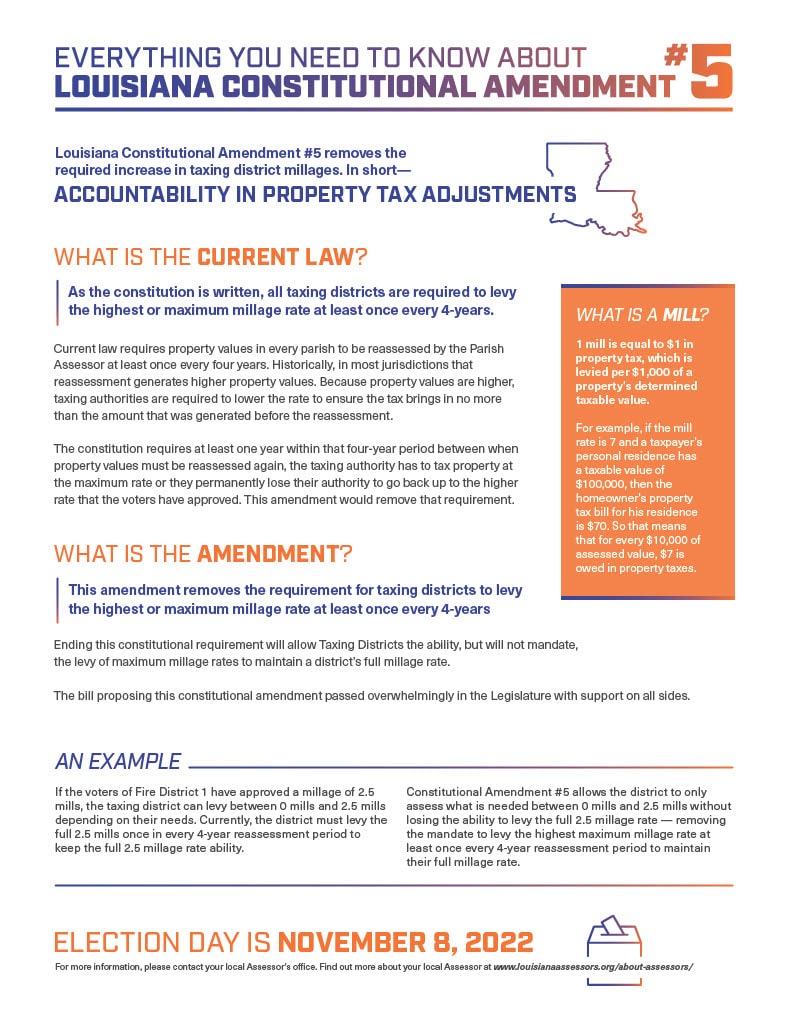

jefferson parish property tax assessment

With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The St Tammany Parish Assessor S Office Proudly Serving St Tammany

If a Homestead Exemption HEX.

. Online Property Tax System. Due to Washington state law RCW 3629190 the Treasurer can not absorb the cost of online payments. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

800 am to 500 pm -- July August. Property Maintenance Zoning Quality of Life. If you do not pay your.

Whether you are presently living here only contemplating taking up residence in Jefferson Parish or planning on investing in its property find out how municipal property taxes work. Find Jefferson Parish residential property tax assessment records tax assessment history land improvement. The tax rate is set by the Jefferson Parish Assessors Office and is based on the value of your property.

Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Motor vehicles are generally taxed in the county of registration as of the assessment date. This property includes all real estate all business.

Please call 504-362-4100 and ask for the personal property. When property is bought and sold the Assessors office records the transfer of the property to reflect the most current owner in preparation for the annual assessment roll. Jefferson Parish Sheriffs Office.

The tax is due on December 31st of each year. For comparison the median home value in Jefferson Parish is. Please contact the Jefferson Parish Sheriff 504-363-5710 for payment options.

To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes. - Homestead Exemption Information for residents of Jefferson Parish Tax Estimate - How to.

They are maintained by. Free Jefferson Parish Assessor Office Property Records Search. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website.

If you do not pay your. Port Townsend WA 98368. The voters of Jefferson Parish recently passed this exemption into law and it becomes effective beginning January 1 2012.

Oct 13 2022 The tax rate is set by the Jefferson Parish Assessors Office and is based on the value of your property. Jefferson County PVA Office. 800am to 400pm175 Arsenal StreetWatertown NY 13601.

Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill BAA Fine. 1233 Westbank Expressway Harvey LA 70058. These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

Payments are processed immediately but may not be reflected for up to 5 business days. Administration Mon-Fri 800 am-400 pm Phone. This gives you the assessment on the parcel.

This exemption is for a 100 disabled veteran as determined by the. Welcome to the Jefferson Parish Assessors office. Jefferson Parish collects on average 043 of a propertys.

Burns Director Office Hours. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street. Pay Online - Property Taxes and Assessments The Treasurers Office uses Point Pay a third party vendor to process online payments.

200 Derbigny St Suite 1100. Jefferson Parish Assessors Office Jefferson Parish Assessor. The site is down for maintenance while the new tax roll is being updated.

Please call the office at 504 363-5710 between 800AM and 430PM Monday. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The tax is due on December 31st of each year.

The preliminary roll is subject to.

Assessment Forms Resources St Tammany Parish Assessor S Office

Jefferson Parish Assessor S Office Home

Jefferson County Tax Office Tax Assessor Collector Of Jefferson County Texas

Louisiana Property Records Search Online By Name Or Address Youtube

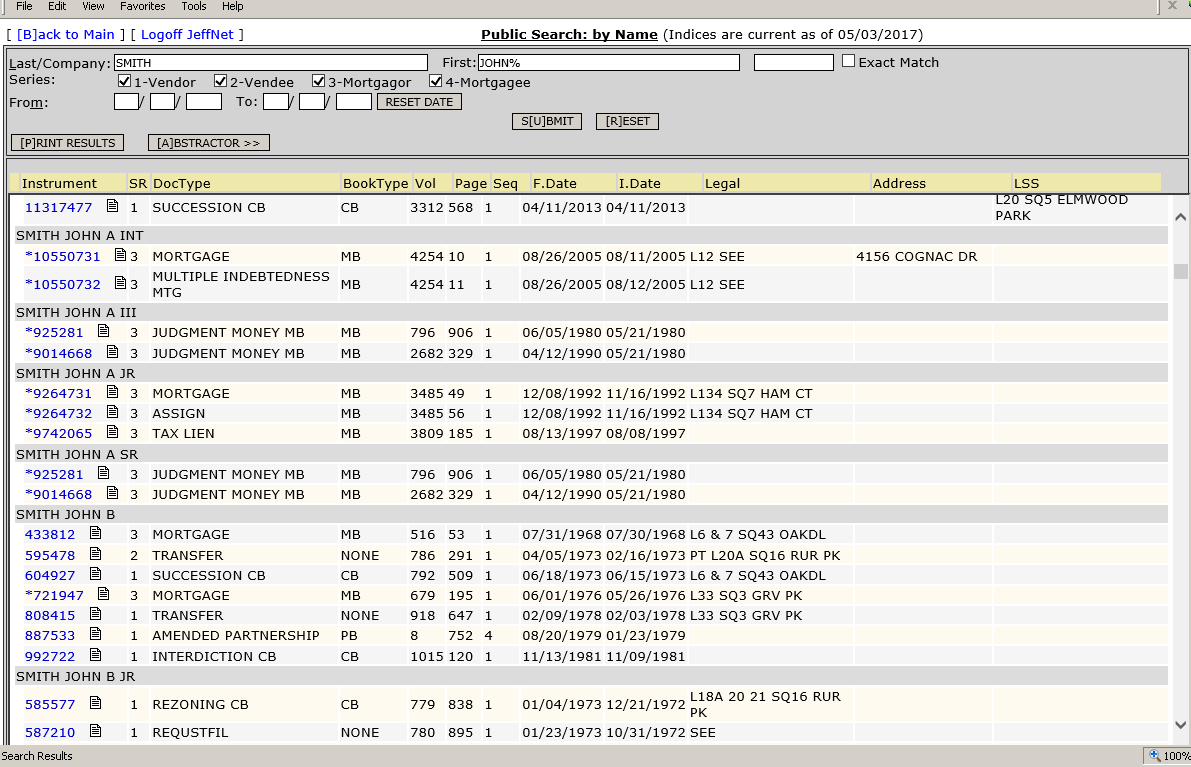

Jefferson Parish Clerk Of Court

St Tammany Parish Property Tax Consultant St Tammany

Jefferson Parish Property Owners Will Pay More Taxes Soon Here S Why Local Politics Nola Com

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Jefferson Parish Louisiana Home

Jefferson Parish Assessor S Office Home

Jefferson Parish Clerk Of Court

St Tammany Parish Property Tax Consultant St Tammany

Bgr Analyzes Jefferson Parish Sheriff S Office Tax On The April 30 Ballot Biz New Orleans

Jeffnet Jefferson Parish Clerk Of Court

Jefferson Parish Finance Authority Jefferson La Facebook