wyoming property tax rate

Residential market value 100000 Residential. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined.

America S 15 States With Lowest Property Tax Rates Bob Vila

Wyoming has one of the lowest median.

. Learn all about Wyoming County real estate tax. Residential property is assessed at 95 of market value. Property used for industrial purposes taxed at 115 All other property Real and Personal taxed at 95 Hopefully the information provided here can shed some light on the process of.

Download or Email FUEL-009 More Fillable Forms Register and Subscribe Now. Taxable value is the value used to calculate taxes due on your property. Edit Sign and Save IFTA Tax Return Form.

Tax amount varies by county. Currently the level of assessment is 115 for industrial use property and 95 for residential agricultural and all other property. Median Income In Wyoming.

The median property tax in Wyoming is 058 of a propertys assesed fair market value as property tax per year. The mission of the Property Tax Division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property. Edit Sign and Save IFTA Tax Return Form.

Johnson County collects on average 056 of a propertys. Wyoming is a tax-friendly state for homeowners. Edit Sign and Save IFTA Tax Return Form.

City of Wyoming Michigan 1155 28th St SW Wyoming MI 49509 616-530-7226 Fax 616-530-7200 Hours of Operation. Wyomings property tax rate for industrial property is 115 while the rate for commercial residential and all other property is 95. The median property tax in Johnson County Wyoming is 1160 per year for a home worth the median value of 208400.

Tax amount varies by county. Whether you are already a resident or just considering moving to Wyoming County to live or invest in real estate estimate local property. Ad Web-based PDF Form Filler.

Taxes in Wyoming Facts The average property tax rate is only 057 making Wyoming the lowest property tax taker. Search Any Address 2. In principle tax amount should equal the amount of all annual funding.

Wyoming ranks in 10th. See Property Records Tax Titles Owner Info More. The median property tax in Wyoming is 058 of a propertys assesed fair market value as property tax per year.

Ad Get In-Depth Property Tax Data In Minutes. Wyoming has among the lowest property taxes in the United States. SignNow allows users to Edit Sign Fill Share all type of documents online.

Wyoming has one of the lowest median. Homeowners pay 567 for every 1000 of home value in property taxes. The median property tax in Wyoming is 105800 per year based on a median home value of 18400000 and a median effective property tax rate of 058.

Start Your Homeowner Search Today. The average Wyoming property tax bill adds up to 1349 which. Download or Email FUEL-009 More Fillable Forms Register and Subscribe Now.

The assessed value is then. Which is a tax imposed according to the value of the property. In addition any additional structures or.

In the state there are a lot of locally. Monday - Thursday 700 AM. Ad Web-based PDF Form Filler.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Wyoming ranks 7th nationally for the lowest. Wyomings tax system ranks.

Then they compute the tax rates allowing to equal those budgeted expenditures. The states average effective property tax rate is 057 10th-lowest in the country including Washington DC. Any sales tax that is collected belongs to the state and does.

Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Wyoming. Closed Friday - Sunday. The median property tax also known as real estate tax in Lincoln County is 91500 per year based on a median home value of and a median effective property.

Ad Web-based PDF Form Filler. The result is assessed value. 23 rows Despite the fact that there is no state income tax in Wyoming it has among the lowest.

A Breakdown Of 2022 Property Tax By State

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Everything You Know About Wyoming Taxes Is Wrong A Better Wyoming

New York City Property Tax Rate Is It Worth Selling

Lenoir City Approves Property Tax Rate Ke Andrews

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Report Tennessee Has Second Lowest Overall Tax Burden The Courier

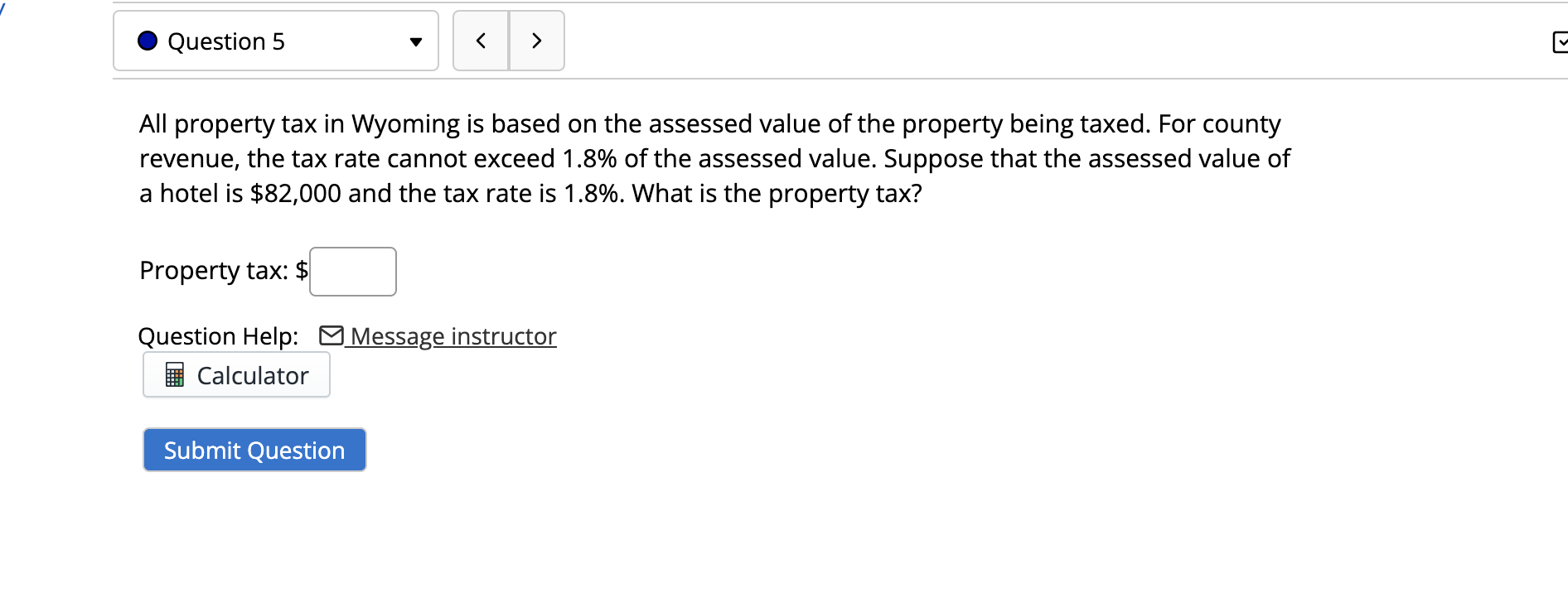

Solved Question 5 5 All Property Tax In Wyoming Is Based Chegg Com

Tax Rates To Celebrate Gulfshore Business

Historical Wyoming Tax Policy Information Ballotpedia

Are There Any States With No Property Tax In 2022 Free Investor Guide

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

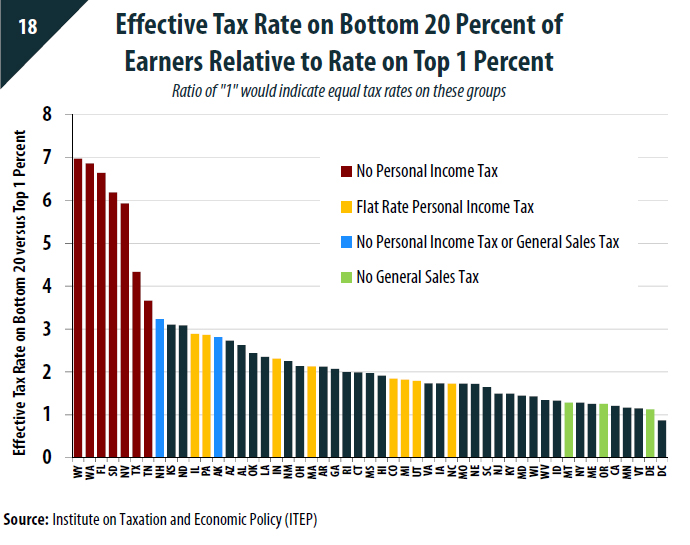

Best Worst State Property Tax Codes Tax Foundation

Fast Guide To Dual State Residency High Net Worth Investors

Think Dallas Fort Worth Property Taxes Are High Well You Re Right

![]()

Tax Friendly States For Retirees Best Places To Pay The Least